Table of Contents

企业自由现金流(FCFF)

什么是企业自由现金流(FCFF)

企业自由现金流(Free cash flow to the firm, FCFF),represents the amount of cash flow from operations available for distribution after depreciation expenses, taxes, working capital, and investments are accounted for and paid. FCFF is essentially a measurement of a company's profitability after all expenses and reinvestments. It is one of the many benchmarks used to compare and analyze a firm's financial health.

关键点:

- Free cash flow to the firm (FCFF) represents the cash flows from operations available for distribution after depreciation expenses, taxes, working capital, and investments are accounted for.

- Free cash flow is arguably the most important financial indicator of a company's stock value.

- A positive FCFF value indicates that the firm has cash remaining after expenses.

- A negative value indicates that the firm has not generated enough revenue to cover its costs and investment activities.

FCFF计算公式

The calculation for FCFF can take several forms, and it's important to understand each version. The most common equation is shown as:

$$ \text{FCFF}=\text{NI}+\text{NC}+(\text{I} \times(1−\text{TR}))−\text{LI}−\text{IWC} $$

其中:

- NI=净利润(Net income)

- NC=非现金支出(Non-cash charges)

- I=利息(Interest)

- TR=税率(Tax Rate)

- LI=长期投资(Long-term Investments)

- IWC=运营资本投资(Investments in Working Capital)

如何计算FCFF

Free cash flow to the firm can also be calculated using other formulations. Other formulations of the above equation include:

$$ \text{FCFF}=\text{CFO}+(\text{IE}\times(1−\text{TR}))−\text{CAPEX} $$

其中:

- CFO=经营现金流(Cash flow from operations)

- IE=利息费用(Interest Expense)

- CAPEX=资本性支出(Capital expenditures)

$$ \text{FCFF}=(\text{EBIT}\times(1−\text{TR}))−\text{D}−\text{LI}−\text{IWC} $$

其中:

- EBIT=息税前利润(Earnings before interest and taxes)

- D=折旧(Depreciation)

$$ \text{FCFF}=(\text{EBITDA}×(1−\text{TR}))+(\text{D} \times \text{TR})−\text{LI}−\text{IWC} $$

其中:

- EBITDA=息税折旧摊销前利润(Earnings before interest, taxes, depreciationand amortization)

FCFF告诉我们什么

FCFF represents the cash available to investors after a company pays all its business costs, invests in current assets (e.g., inventory), and invests in long-term assets (e.g., equipment). FCFF includes bondholders and stockholders when considering the money left over for investors.

The FCFF calculation is a good representation of a company's operations and its performance. FCFF considers all cash inflows in the form of revenues, all cash outflows in the form of ordinary expenses, and all reinvested cash to grow the business. The money left over after conducting all these operations represents a company's FCFF.

Free cash flow is arguably the most important financial indicator of a company's stock value. The value/price of a stock is considered to be the summation of the company's expected future cash flows. However, stocks are not always accurately priced. Understanding a company's FCFF allows investors to test whether a stock is fairly valued. FCFF also represents a company's ability to pay dividends, conduct share repurchases, or pay back debt holders. Any investor looking to invest in a company's corporate bond or public equity should check its FCFF.

A positive FCFF value indicates that the firm has cash remaining after expenses. A negative value indicates that the firm has not generated enough revenue to cover its costs and investment activities. In that instance, an investor should dig deeper to assess why this is happening. It can be a result of a specific business purpose, as in high-growth tech companies that take consistent outside investments, or it could be a signal of financial issues.

FCFF举例

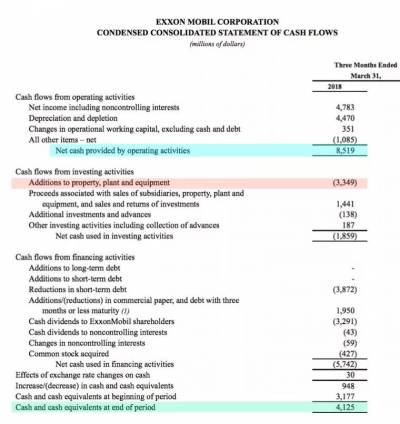

If we look at Exxon's statement of cash flows, we see that the company had \$8.519 billion in operating cash flow (below, in blue). The company also invested in a new plant and equipment, purchasing \$3.349 billion in assets (in red). The purchase is a CAPEX cash outlay. During the same period, Exxon paid \$300 million in interest subject to a 30% tax rate.

Exxon Cash Flows.

FCFF can be calculated using this version of the formula:

$$ \text{FCFF}=\text{CFO}+(\text{IE}\times(1−\text{TR}))−\text{CAPEX} $$

In the above example, FCFF would thus be calculated as follows:

$$

\begin{aligned}

\text{FCFF} &= \$8,519 \text{Billion} + (\$300 \text{Million} \times (1 - 0.30 ) ) - \$3,349 \text{Billion}

&= \$5.38 \text{Billion}

\end{aligned}

$$

现金流和FCFF之间的区别

Cash flow is the net amount of cash and cash equivalents being transferred into and out of a company. Positive cash flow indicates that a company's liquid assets are increasing, enabling it to settle debts, reinvest in its business, return money to shareholders and pay expenses.

Cash flow is reported on the cash flow statement, which contains three sections detailing activities. Those three sections are cash flow from operating activities, investing activities and financing activities.

FCFF is the cash flows a company produces through its operations after subtracting any outlays of cash for investment in fixed assets like property, plant and equipment as well as after depreciation expenses, taxes, working capital, and interest are accounted for. In other words, free cash flow to the firm is the cash left over after a company has paid its operating expenses and capital expenditures.

FCFF的限制

Although it provides a wealth of valuable information that investors really appreciate, FCFF is not infallible. Crafty companies still have leeway when it comes to accounting sleight of hand. Without a regulatory standard for determining FCFF, investors often disagree on exactly which items should and should not be treated as capital expenditures.

Investors must thus keep an eye on companies with high levels of FCFF to see if these companies are under-reporting capital expenditure and research and development. Companies can also temporarily boost FCFF by stretching out their payments, tightening payment collection policies and depleting inventories. These activities diminish current liabilities and changes to working capital, but the impacts are likely to be temporary.